Playa del Carmen, a charming beach city on the Riviera Maya, has experienced significant growth in its real estate market. This vibrant destination attracts both investors and travelers, making it a hotspot for property appreciation. The unique blend of local charm and evolving infrastructure plays a crucial role in shaping its real estate dynamics.

Understanding the local market trends and broader economic factors is essential for making informed investment decisions. Playa del Carmen’s real estate market is influenced by its appeal as a top tourist destination, with areas offering easy access to amenities and attractions seeing high demand. This guide will delve into data-driven insights and success stories, helping you navigate the local market with confidence.

Key Takeaways

- Playa del Carmen’s real estate market is driven by its appeal as a top tourist destination.

- Neighborhoods with easy access to amenities and attractions see higher property appreciation.

- Understanding local market trends and economic factors is crucial for smart investments.

- The city’s unique charm and infrastructure contribute to its real estate growth.

- This guide provides data-driven insights into the local market and success stories.

Introduction to the Ultimate Guide on Playa del Carmen Real Estate

Welcome to our comprehensive guide on Playa del Carmen real estate! Whether you’re a seasoned investor or a first-time buyer, this guide is designed to empower you with the insights needed to make informed decisions in Mexico’s thriving Riviera Maya market.

An Overview of the Riviera Maya Market

Mexico’s economy has shown remarkable stability and growth, particularly in the Riviera Maya region. This area has become a hotspot for investors due to its vibrant demographics and favorable market conditions. The real estate market in Riviera Maya has evolved significantly from 2020 to 2024, shaped by rising investor confidence and a growing population.

Setting the Stage for Smart Investment Decisions

Our guide offers a detailed look at both local demographics and the increasing interest from international investors. With a focus on data-driven insights, we invite you to explore the opportunities in Playa del Carmen and the broader Riviera Maya region. By understanding recent trends and market dynamics, you’ll be better equipped to make smart investment choices.

- Discover Mexico’s broad economic landscape and its impact on the Riviera Maya.

- Explore recent trends shaping investor confidence from 2020 to 2024.

- Gain insights into local demographics and international investor interest.

- Learn how to make data-driven investment decisions with expert analysis.

Join us as we delve into the intricacies of the Riviera Maya market and uncover the potential it holds for your next investment venture.

Understanding Playa del Carmen property appreciation

The real estate market in this coastal city has seen remarkable growth, fueled by rising demand and strategic pricing. As a top tourist destination, it attracts both investors and travelers, creating a hotspot for value growth.

Recent data shows significant price increases over the past few years. Factors such as economic stability, infrastructure development, and the region’s appeal drive these trends. The Maya region’s influence further enhances the market’s strength.

“Location is key in real estate. Proximity to amenities and attractions significantly impacts value growth.”

| Factor | Impact on Price | Market Influence |

|---|---|---|

| Economic Growth | 10-15% annual increase | Strong demand, limited supply |

| Infrastructure Development | 8-12% rise | Improved accessibility, new projects |

| Regional Appeal | 5-10% growth | Increased investor interest |

These elements set the stage for detailed neighborhood analyses, helping investors make informed decisions. For more on high-ROI properties, visit our expert guide.

Key Neighborhoods Driving High Property Appreciation Rates

Investors are drawn to vibrant neighborhoods where strategic location and amenities drive growth. Playa del Carmen’s real estate market highlights areas like 5th Avenue, Playacar, and Centro, each offering unique appeal.

Exploring 5th Avenue, Playacar, and Centro

5th Avenue captivates with its lively atmosphere, making it a hotspot for both tourists and investors. Playacar stands out as an upscale area with modern amenities, while Centro blends historic charm with dynamic energy.

Navigating Investment Hotspots

Buyers often seek condos in these areas for their high appreciation potential. Houses, while less common, offer unique value in certain neighborhoods. Understanding local trends helps investors make informed decisions.

These neighborhoods provide a clear roadmap for navigating Playa del Carmen’s top investment areas, empowering buyers to make smart choices.

Economic and Demographic Factors Shaping the Market

Economic and demographic factors play a pivotal role in shaping the real estate market dynamics of Playa del Carmen. Understanding these elements is crucial for investors looking to capitalize on the region’s growth.

Mexico’s Demographic Trends and Growth

Mexico’s population growth and migration patterns have significantly influenced the real estate market. Over the past few years, the country has experienced steady demographic shifts, with more people moving to urban areas like Playa del Carmen. This migration has led to increased demand for housing and rental properties, creating opportunities for investors.

- Mexico’s population growth has been modest but steady, contributing to higher demand for real estate.

- Migration trends, both domestic and international, have shifted the dynamics of the local market.

- Urban areas like Playa del Carmen have seen a surge in population, driving up property values.

Impact of Trade, Remittances, and Re-Shoring

Trade agreements, remittances, and re-shoring initiatives have further bolstered the market. These factors have attracted both domestic and international investors, stabilizing the real estate sector.

Remittances from abroad, particularly from the United States, have injected significant capital into the Mexican economy. This influx of funds has enabled many individuals to invest in real estate, further driving property appreciation.

| Factor | Impact on Market | Key Influence |

|---|---|---|

| Trade Agreements | Increased Foreign Investment | Stabilized Market Growth |

| Remittances | Higher Purchasing Power | Boosted Local Demand |

| Re-Shoring | Job Creation | Enhanced Economic Activity |

These economic integrations have fostered a favorable environment for real estate investment, making Playa del Carmen an attractive choice for both domestic and international buyers.

Tourism, Digital Nomads, and Their Impact on Property Values

Tourism and the rise of digital nomads have become powerful drivers of the local real estate market, creating new opportunities for investors. This vibrant trend is reshaping how we think about rental properties and their potential for strong returns.

The Rise of Digital Nomads in Playa del Carmen

Digital nomads are flocking to this coastal city, drawn by its unique blend of beach lifestyle and modern amenities. With the demand for short-term rentals on the rise, properties in areas like 5th Avenue and Centro are seeing higher occupancy rates and better returns for buyers.

How Tourism Fuels Short-Term Rental Markets

Tourism plays a crucial role in sustaining the rental market. The appeal of beach destinations like Tulum and nearby areas attracts a steady stream of visitors, creating consistent demand for short-term rentals. This trend not only boosts rental income but also contributes to rising property values.

| Factor | Impact on Rentals | Market Influence |

|---|---|---|

| Digital Nomads | Increased demand for flexible, short-term rentals | Higher occupancy rates and rental returns |

| Tourism Growth | Steady flow of visitors seeking accommodations | Stronger demand for vacation rentals |

| Beach Lifestyle | Desirability of coastal properties | Higher property values and investor interest |

This symbiotic relationship between tourism and digital nomads creates a win-win scenario for investors. As more buyers recognize the potential of these market segments, the demand for strategically located properties continues to grow.

Infrastructure Developments Fuelling Real Estate Growth

Infrastructure improvements are playing a crucial role in shaping the real estate market in Playa del Carmen and the Riviera Maya. Major projects like the Mayan Train and airport expansions in Tulum and Cancun are significantly enhancing regional connectivity, which in turn is boosting property values.

The Mayan Train and Airport Enhancements

The Mayan Train project is a game-changer for the region. This ambitious initiative aims to connect key tourist destinations across the Yucatan Peninsula, improving accessibility and attracting more visitors. Enhanced airport access from Cancun further supports this growth, making it easier for international travelers to reach Playa del Carmen.

- The Mayan Train will connect major tourist hubs, boosting the region’s appeal.

- Improved airport access from Cancun enhances connectivity for international visitors.

Government Initiatives and Regional Connectivity

Government efforts to enhance regional connectivity are spotlighted as key drivers of real estate growth. These initiatives not only improve transportation but also create jobs and stimulate economic activity, making the area more attractive to investors.

- Government projects focus on better connectivity and economic stimulation.

- Improved access directly correlates with higher market rates and returns.

These infrastructure developments create a favorable environment for real estate investment. For more details on financing options, visit our expert guide.

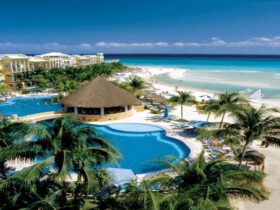

Lifestyle and Walkability Advantages in Playa del Carmen

Playa del Carmen stands out as a beacon of urban charm and walkability in the Riviera Maya. Its vibrant lifestyle and accessible amenities make it a top choice for both residents and investors. The city’s unique blend of modern living and community vibrancy creates an irresistible appeal.

Urban Living and Community Vibrancy

Living in Playa del Carmen offers a unique urban experience. Walkable neighborhoods, a thriving community life, and easy access to amenities are just a few of the advantages that make this city special. Whether you’re strolling through the bustling streets or enjoying local cuisine, the city’s energy is contagious.

The heart of Playa del Carmen is its lifestyle. From shopping along 5th Avenue to immersing yourself in cultural experiences, every moment here is an opportunity to connect with the community. This vibrant urban life not only enhances the quality of living but also adds value to investments.

| Lifestyle Factor | Impact on Desirability | Investor Benefits |

|---|---|---|

| Walkable Neighborhoods | High demand for convenient locations | Increased property values |

| Vibrant Community Life | Attracts diverse residents and visitors | Strong rental demand |

| Access to Amenities | Enhances overall living experience | Higher occupancy rates |

Playa del Carmen’s service-rich environment and central location make it a standout choice. The city’s ability to blend urban living with a relaxed coastal lifestyle sets it apart from other resort destinations. For those seeking a vibrant community and high-quality amenities, Playa del Carmen offers the perfect blend of life and opportunity.

Comparative Review of Investment Hotspots in the City

Investors often find themselves weighing the benefits of established hotspots versus emerging neighborhoods in the city. Each offers unique advantages, shaping the investment landscape in distinct ways.

Core Hot Spots Versus Emerging Neighborhoods

Established areas like 5th Avenue and Centro are renowned for their high demand and vibrant amenities, making them prime locations for condo sales. These spots often see stable market conditions and consistent returns.

In contrast, emerging neighborhoods may offer lower entry points with promising growth potential. While they might lack the immediate demand of core hotspots, they present opportunities for higher returns in the long term.

- Core Hotspots: High demand, stable sales, and prime locations like condos in the city center.

- Emerging Areas: Lower prices, growth potential, and diverse market dynamics.

Understanding these factors helps investors make informed decisions, balancing immediate returns with future growth potential. This analysis is key to navigating the city’s investment opportunities effectively.

Insights into the Long-Term Rental and Resale Markets

Understanding the dynamics of rental and resale markets is crucial for making informed investment decisions. While short-term rentals offer flexibility, long-term rentals provide stability, each with unique benefits for investors.

Short-Term vs. Long-Term Rental Opportunities

Short-term rentals attract tourists and digital nomads, offering higher returns during peak seasons. However, they require more management and can experience fluctuations. Long-term rentals, while yielding lower monthly returns, provide consistent income and lower vacancy rates.

| Rental Type | Return | Occupancy Rate | Stability |

|---|---|---|---|

| Short-Term | Higher (up to 15%) | 80%+ in peak seasons | Variable |

| Long-Term | Steady (8-10%) | 90%+ annually | High |

Experienced agents can guide investors through these options, ensuring informed decisions. For those considering pre-construction investments, explore the benefits here. Balancing rental and resale strategies is key for sustained profitability in this dynamic market.

Market Trends and New Developments in 2024

The real estate landscape in 2024 is thriving with innovative developments and a strong focus on sustainability. This year has brought significant changes, with a notable 15% increase in property values across the Riviera Maya, driven by eco-friendly initiatives and a surge in construction activity.

Upcoming Projects and Sustainable Developments

One of the most exciting trends in 2024 is the rise of sustainable developments. These projects not only appeal to environmentally conscious buyers but also offer higher returns on investment. Luxury developments are also gaining traction, attracting high-net-worth individuals who seek modern amenities and prime locations.

- The market is experiencing a surge in new property developments, many emphasizing sustainability and luxury.

- Residential and commercial segments are both benefiting from these trends, with increased demand for eco-friendly and high-end properties.

- Data shows strong market performance, with rising rental yields and growing investor interest.

- These developments provide valuable insights for investors looking to capitalize on future market potentials.

As we look ahead, the combination of sustainable practices and luxury offerings is expected to shape the future of real estate. Investors who align with these trends can anticipate promising returns and long-term growth. Stay informed to make the most of these emerging opportunities in 2024 and beyond.

Success Stories and Case Studies of Real Estate Investments

Real-world success stories are a powerful way to understand the potential of real estate investments. These case studies highlight the achievements of investors who have capitalized on the local market’s growth.

Investor Testimonials and Real Data Performance

Meet John and Sarah, who purchased a beachfront condo for $250,000. They achieved a 12% ROI through rental income and saw a 20% appreciation in just three years. Their story exemplifies the lucrative opportunities available to investors.

| Investment Detail | Performance | Outcome |

|---|---|---|

| Purchase Price | $250,000 | 12% Annual ROI |

| Annual Rental Income | $30,000 | 20% Appreciation |

| Hold Period | 3 Years | Total Gain: $50,000 |

The USMCA and nearshoring trends have further boosted the market, attracting international businesses. This area’s appeal, with its mix of tourism and expat communities, offers steady rental income and growth opportunities. Recent designs now include workspaces, catering to digital nomads, enhancing the area’s appeal and investment potential.

Navigating the Buying Process in Mexico for Foreign Investors

Buying real estate in Mexico can seem complex for foreign investors, but with the right guidance, it can be a smooth process. Understanding the legal framework and selecting the right professionals are key to a secure and successful investment.

Understanding the Fideicomiso (Trust) Process

Foreign investors in Mexico’s restricted zones, which include coastal areas, must use a fideicomiso (trust) to purchase property. This trust, held by a Mexican bank, allows ownership for up to 50 years and is renewable. The process ensures legal compliance and provides a secure way to hold property.

Tips for Selecting a Reputable Realtor

Choosing a reliable realtor is crucial. Look for agents with experience in helping international clients. They can guide you through the fideicomiso process and ensure transparency. A knowledgeable agent will help you navigate Mexico’s real estate market with confidence.

- Experience with international transactions is essential for a smooth process.

- A reputable agent will provide clear guidance on legal requirements.

- Local knowledge ensures you find the best investment opportunities.

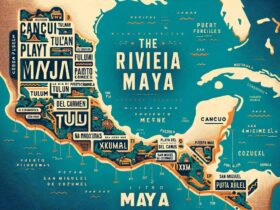

Regional Market Comparison: Playa del Carmen, Tulum, Cancun, and More

Exploring the diverse real estate landscapes of Riviera Maya, we compare key destinations like Tulum, Cancun, and Playa del Carmen. Each area offers unique charm and investment opportunities, shaped by distinct market dynamics.

Key Differences in Neighborhood Appeal and Pricing

Understanding what makes each city unique is crucial for investors. Tulum captivates with its lush jungles and Mayan heritage, attracting eco-conscious buyers. Its upscale vibe and limited beachfront properties drive higher prices, with average beachfront lots at $200,000. Yet, Tulum’s average ROI impresses at 8-15%, making it a top choice for many.

In contrast, Cancun offers affordability and infrastructure. As a major hub, it provides lower entry costs and high liquidity, appealing to budget-conscious investors. However, rental yields here are lower, averaging 8%, reflecting its broader market dynamics.

Playa del Carmen blends urban vibrancy with coastal relaxation. Its walkable neighborhoods and amenities attract digital nomads and families. Prices here are moderate, with beachfront properties averaging $8,142 per square meter, offering balanced investment potential.

- Tulum: High-end, eco-friendly, with strong ROI but higher prices.

- Cancun: Affordable entry points, lower yields, and high liquidity.

- Playa del Carmen: Moderate pricing, vibrant lifestyle, and balanced returns.

Each city caters to different buyer preferences. Tulum suits luxury seekers, Cancun appeals to budget-minded investors, and Playa del Carmen offers a middle ground. Understanding these dynamics helps investors choose the best fit for their strategy.

Leveraging Data and Analytics for Investment Decisions

Smart investment decisions are rooted in solid data and analytics. With advanced tools now available, investors can access precise numbers on rental yields, occupancy rates, and overall market performance, as highlighted in recent studies. These insights empower investors to make informed choices, ensuring their strategies are both effective and profitable.

Tools and Resources for Market Research

The market offers a variety of tools to aid in research. Rental yield and occupancy rate calculators are invaluable, providing clear metrics that guide investors in selecting the right properties. For instance, a rental yield calculator can determine the annual return on investment, while occupancy rate tools predict tenancy demand. These resources help investors balance risk and reward, ensuring their investments align with market trends.

Understanding Rental Yields and Occupancy Rates

Rental yields and occupancy rates are crucial metrics for investors. Rental yield indicates the return on investment, while occupancy rates show how often a property is rented. For example, a condo with a high occupancy rate may offer stable income, even if the yield is moderate. Conversely, a condo with lower occupancy but higher yield might appeal to those seeking quick returns.

| Metric | Short-Term Rental | Long-Term Rental |

|---|---|---|

| Rental Yield | Higher (up to 15%) | Steady (8-10%) |

| Occupancy Rate | 80%+ in peak seasons | 90%+ annually |

| Stability | Variable | High |

“Data is the compass for investors, guiding them through market fluctuations and ensuring informed decisions.”

By leveraging these tools and understanding the metrics, investors can navigate the market with confidence, making choices that enhance their investment outcomes.

Conclusion

In conclusion, our comprehensive guide has shown how understanding market trends, infrastructure, and success stories makes investing in this vibrant coastal city a smart choice. By exploring the insights and stories shared, you’re well-equipped to make informed decisions.

Timing and careful planning are key to successful investments. Whether you’re seeking a place to call home or a promising venture, this dynamic market offers something for everyone. Our goal is to guide you in navigating its intricacies with confidence.

We encourage you to keep exploring, researching, and consulting with trusted experts. With the right approach, you can unlock the full potential of this thriving real estate landscape. Let us help you make the most of your journey in this beautiful region.