Welcome to our comprehensive guide designed to help vacation rental owners protect their investments in one of Mexico’s most sought-after destinations. Whether you’re managing a cozy beachfront property or a luxurious villa, safeguarding your rental is crucial for peace of mind.

Owning a vacation property in this vibrant area comes with unique opportunities and challenges. From unexpected damages to liability concerns, having the right coverage ensures you’re prepared for any situation. We’re here to guide you through the process of selecting the best policies tailored to your needs.

Our expert insights are based on industry data and real-life experiences, ensuring you make informed decisions. We’ll walk you through step-by-step instructions to help you navigate the world of insurance with confidence. Let’s dive in and explore how you can protect your property and enjoy worry-free ownership.

Key Takeaways

- Insurance is vital for protecting your vacation rental property and personal liability.

- Understanding the unique rental market in this area helps in choosing the right coverage.

- Expert advice ensures you make smart, informed insurance decisions.

- Step-by-step guidance simplifies the process of selecting the best policies.

- Peace of mind comes from knowing your investment is secure.

Understanding Playa del Carmen Rental Insurance

Navigating the world of property protection in Mexico requires a clear understanding of local insurance policies. Unlike standard plans, policies here are tailored to address unique risks, such as weather-related damages or liability concerns. This makes it essential to choose the right coverage for your vacation home.

One term you’ll often encounter is full coverage insurance. This type of policy goes beyond basic protection, offering comprehensive safeguards for property damage and personal liability. It’s particularly valuable in areas prone to natural events or high tourist activity.

When it comes to reliable providers, Discover Cars stands out as a trusted name. Known for their transparent policies and excellent customer service, they simplify the process of securing the right plan. Whether you’re renting a car or protecting your property, they offer tailored solutions.

Insurance packages vary widely. Basic plans cover essential damages, while comprehensive options include additional protections like theft or vandalism. Understanding these differences helps you make informed decisions that align with your needs.

Finally, it’s crucial to familiarize yourself with local legal requirements. Mexico has specific regulations that may impact your coverage choices. Staying informed ensures your property is fully protected and compliant with local laws.

Why Insurance is Critical for Vacation Rental Owners in Playa del Carmen

Protecting your vacation home is more than just a precaution—it’s a necessity. In a bustling tourist destination, unexpected events can happen at any time. From property damage to guest injuries, having the right coverage ensures you’re prepared for the unexpected.

Without sufficient insurance, you could face significant financial risks. Imagine a guest accidentally damaging your property or a storm causing unexpected repairs. These situations can quickly become costly if you’re not covered. Insurance acts as a safety net, shielding you from these potential losses.

Real-world examples highlight the importance of proper coverage. One owner faced a hefty bill after a guest’s rental car accident damaged their driveway. Another dealt with unexpected legal fees when a guest slipped and fell on their property. These scenarios show how vital insurance is for protecting your investment and ensuring guest safety.

Using a credit card with built-in insurance coverage can also provide an additional layer of protection. Many cards offer benefits like collision damage waivers for rent car services or travel insurance. While these shouldn’t replace a comprehensive policy, they can complement your existing coverage.

Finally, seeking expert advice is key to selecting the right policy. Professionals can help you navigate the complexities of insurance and tailor a plan to your specific needs. With the right guidance, you can enjoy peace of mind knowing your property and guests are protected.

Common Insurance Policies for Vacation Rentals

When managing a vacation property, understanding the right insurance policies is essential for safeguarding your investment. Whether you’re dealing with unexpected damages or guest-related incidents, having the proper coverage ensures peace of mind. Let’s explore the most common policies and how they can protect your property.

Property Damage Coverage

Property damage coverage is a cornerstone of any insurance plan. It protects your property from unforeseen events like storms, fires, or accidents. For example, if a guest accidentally damages furniture or a natural event causes structural harm, this policy ensures repairs are covered.

Common claims include broken appliances, water damage, and vandalism. These incidents can happen at any time, making this coverage a must-have. Think of it as a safety net for your property’s physical integrity.

Personal Liability Protection

Personal liability protection is equally important. It covers you if a guest is injured on your property or if their actions cause damage to third parties. For instance, if a guest slips and falls or accidentally damages a neighbor’s property, this policy steps in to cover legal fees and medical expenses.

This type of coverage is especially valuable in high-traffic areas. It ensures you’re not held financially responsible for accidents beyond your control.

When comparing policies, full coverage options often include both property damage and personal liability protection. These comprehensive plans are ideal for those seeking maximum security. On the other hand, basic policies may cover only essential damages, making them more cost-effective but less inclusive.

For example, car Mexico insurance policies often mirror these concepts. A full coverage car insurance plan includes collision, theft, and liability, while basic plans may only cover accidents. Similarly, vacation property insurance can be tailored to your specific needs.

Cost implications vary based on the level of coverage and the frequency of claims. Real-life cases show that investing in comprehensive protection can save you from significant financial burdens. For instance, a property owner avoided hefty repair costs after a storm thanks to their full coverage policy.

For more insights on securing the best policies, check out our guide on exclusive resort packages, which includes tips on maximizing your investment.

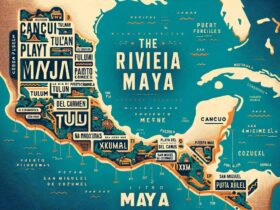

Navigating Local Regulations and Mandatory Coverages

Understanding local regulations is key to protecting your vacation property in Mexico. The legal landscape here includes specific rules that impact property and vehicle insurance. Staying compliant ensures your investment is secure and avoids potential legal issues.

In this region, mandatory coverages often include liability and property damage protection. These requirements are designed to safeguard both owners and guests. For example, a rental company must ensure their policies meet local standards to operate legally.

Geographical checkpoints like Cancun Airport also play a role. Visitors renting vehicles must show proof of insurance that complies with local laws. This ensures all parties are protected in case of accidents or damages.

To verify compliance, start by reviewing your policy details. Look for clauses that address local regulations. Many providers offer plans tailored to regional requirements, often priced in usd per day or month for convenience.

For more insights on enhancing your property’s appeal, check out our guide on must-have resort amenities. These tips can help you create a welcoming environment while staying compliant with local rules.

Comparing Insurance Options: Basic vs. Full Coverage

Choosing the right insurance for your vacation property can make all the difference in protecting your investment. Whether you’re managing a beachfront villa or a cozy retreat, understanding the differences between basic and full coverage is essential. Let’s break down the pros and cons of each to help you make an informed decision.

Full Coverage Benefits

Full coverage insurance offers comprehensive protection for your property. It includes safeguards against damages, theft, and liability issues. For example, if a guest accidentally damages your furniture or a storm causes structural harm, this policy ensures repairs are covered.

Providers like Discover Cars offer full coverage options that go beyond basic plans. These include collision damage waivers and liability protection, making them ideal for high-traffic areas. Real-life cases show how full coverage has saved property owners from significant financial losses.

Cost-Effective Basic Policies

Basic insurance is a budget-friendly option for those seeking essential protection. It typically covers property damage and minor incidents. However, it may not include theft, vandalism, or liability claims, leaving you vulnerable to unexpected costs.

For instance, basic policies from car rental companies in Mexico often exclude collision and theft coverage. While these plans are more affordable, they may not provide the security you need for a vacation property. Weighing the cost against potential risks is crucial when choosing this option.

To make the best decision, consider your property’s location, guest traffic, and potential risks. For more insights on enhancing your property’s appeal, check out our guide on top all-inclusive resorts. This resource can help you create a welcoming environment while ensuring your property is fully protected.

How to Assess Your Rental’s Insurance Needs

Assessing your property’s insurance needs is a critical step in safeguarding your investment. Coastal areas like Carmen present unique risks, from weather-related damages to high guest turnover. By understanding these factors, you can choose the right coverage to protect your property and ensure peace of mind.

Evaluating Property Risks

Start by identifying the specific risks your property faces. Coastal properties are often exposed to hurricanes, flooding, and saltwater corrosion. Additionally, high guest traffic increases the likelihood of accidental damages or theft. Here’s a step-by-step approach to evaluating these risks:

- Conduct a property inspection: Look for vulnerabilities like outdated wiring or weak roofing.

- Assess location-specific threats: Research historical weather patterns and crime rates in the area.

- Consider guest behavior: Frequent turnovers can lead to wear and tear or accidental damages.

Using a checklist ensures you don’t overlook any potential risks. For a detailed guide on maximizing your property’s value, explore our insights on high ROI properties.

Determining Coverage Limits

Once you’ve identified the risks, it’s time to determine the right coverage limits. This ensures you’re fully protected without overpaying for unnecessary extras. Here’s how to make sure your policy is comprehensive:

- Calculate replacement costs: Estimate the cost of rebuilding or repairing your property in case of damage.

- Factor in liability: Ensure your policy covers guest injuries or damages to third parties.

- Include additional protections: Consider add-ons like theft or vandalism coverage for extra security.

Professional appraisals can help quantify your risk exposure. For example, a property owner in a hurricane-prone area increased their coverage limits after a professional assessment revealed potential repair costs exceeding their initial estimate.

By following these steps, you can make sure your policy is tailored to your property’s unique needs. This proactive approach not only protects your investment but also enhances your guests’ experience by ensuring their safety and comfort.

Tips for Securing Affordable Rental Insurance

Finding affordable insurance for your property doesn’t have to be overwhelming. With the right strategies, you can secure the best deals while ensuring comprehensive coverage. Let’s explore actionable tips to help you save without compromising on protection.

Utilizing Online Platforms

Online platforms are a game-changer for comparing insurance options. Websites like Discover Cars allow you to review multiple policies side by side. This saves time and helps you identify the most cost-effective plans.

Start by entering your property details and desired coverage. Most platforms provide instant quotes, making it easy to compare prices and features. Look for user reviews to gauge the reliability of each provider.

Leveraging Competitive Quotes

Comparing quotes from different companies is essential for finding affordable insurance. Don’t settle for the first offer you receive. Instead, request quotes from at least three providers to ensure you’re getting the best deal.

Here’s a quick comparison of popular insurance providers:

| Provider | Coverage Type | Average Cost (USD/month) |

|---|---|---|

| Discover Cars | Full Coverage | $50 |

| Provider A | Basic | $30 |

| Provider B | Comprehensive | $60 |

Understanding terms related to road use and travel scenarios is also crucial. This ensures your policy covers all potential risks, giving you peace of mind.

Finally, don’t hesitate to negotiate terms or ask about discounts. Many companies offer promotions for new customers or bundled services. By following these tips, you can secure affordable insurance without compromising on quality.

Integrating Car Rental Insurance Options for Vacation Guests

Enhancing your guests’ experience with car rental insurance options can set your property apart. Offering these choices not only adds value but also ensures their safety and convenience during their stay. Let’s explore how integrating these options can benefit both you and your guests.

Understanding Collision and Liability Coverage

Collision and liability coverage are essential components of car rental insurance. Collision coverage protects against damages to the rental vehicle in case of an accident. Liability coverage, on the other hand, safeguards against costs if the guest is responsible for injuring someone or damaging another vehicle.

These protections are particularly important in high-traffic areas or unfamiliar driving conditions. By offering these options, you ensure your guests are prepared for any situation, enhancing their overall experience.

Benefits of Full Coverage Insurance for Vehicles

Opting for full coverage insurance provides comprehensive protection for rental vehicles. This includes collision, liability, theft, and even vandalism. For example, if a guest’s rental car is stolen or damaged in a storm, full coverage ensures they’re not left with unexpected expenses.

Companies like Discover Cars offer full coverage options that are easy to understand and activate. These plans provide peace of mind, making them a popular choice among travelers.

Integrating these options into your property’s offerings is straightforward. Partnering with reliable providers like Discover Cars allows you to seamlessly add car rental insurance to your guest services. The process typically involves minimal paperwork and can be activated online or through mobile apps.

By providing these options, you not only enhance your guests’ experience but also protect your property from potential liabilities. It’s a win-win solution that sets your vacation rental apart in a competitive market.

Insurance Considerations for Short-Term vs. Long-Term Rentals

Insurance needs vary significantly between short-term and long-term stays, and understanding these differences is crucial. Whether your guests stay for a day or several months, their coverage requirements will differ. Let’s explore how to tailor your policies to meet these unique needs.

For short-term stays, insurance often focuses on immediate risks like accidental damages or theft. Policies are typically priced per day, making them flexible but potentially costly for frequent turnovers. For example, a guest staying for a week may need coverage for minor incidents, such as broken appliances or accidental spills.

Long-term rentals, on the other hand, require more comprehensive protection. Extended stays increase the likelihood of wear and tear, making policies with higher coverage limits essential. These plans are often more cost-effective when calculated monthly, providing better value for extended durations.

Using a card for deposits or payments can also impact your insurance strategy. Many providers in Mexico require a credit or debit card for security purposes. This ensures that any damages or unpaid fees can be covered directly, reducing your financial risk.

Here’s a quick comparison of insurance costs for different durations:

| Duration | Coverage Type | Average Cost (USD) |

|---|---|---|

| Short-Term (Per Day) | Basic | $10 |

| Long-Term (Monthly) | Comprehensive | $200 |

Local practices, such as those at car Cancun rental hubs, offer valuable insights. For instance, short-term car rentals often include collision waivers, while long-term leases require full coverage. Applying these principles to property insurance ensures your guests are protected, regardless of their stay length.

By understanding these differences, you can choose the right policy for your property. Whether it’s a quick getaway or an extended stay, the right coverage ensures peace of mind for both you and your guests.

The Role of Credit Card Insurance in Your Overall Policy

Credit card insurance can be a valuable addition to your overall protection strategy for vacation properties. Many travelers and property owners overlook this benefit, but it can provide an extra layer of security in unexpected situations. Let’s explore how it works and how you can integrate it effectively.

Credit card insurance often serves as supplementary coverage for both properties and guest vehicles. For example, if a guest rents a car in Cancun, their credit card might cover collision damage or theft. This can reduce the need for additional policies and save money in the long run.

However, there are limitations to consider. Most credit card policies exclude certain scenarios, like extreme weather damage or liability claims. They also require the cardholder to decline the rental company’s insurance, which can be risky if the credit card coverage isn’t comprehensive.

“Credit card insurance is a great backup, but it shouldn’t replace a standalone policy. Always verify the fine print to ensure you’re fully protected.”

When traveling to destinations like Cancun or beach areas, specific conditions apply. For instance, some cards exclude coverage for off-road driving or accidents involving alcohol. Understanding these restrictions helps you avoid gaps in protection.

Here’s a quick comparison of credit card insurance benefits:

| Benefit | Coverage | Limitations |

|---|---|---|

| Collision Damage | Up to $50,000 USD | Excludes off-road accidents |

| Theft Protection | Full vehicle value | Requires police report |

| Liability Coverage | Up to $100,000 USD | Excludes alcohol-related incidents |

Real-world examples show how credit card insurance has helped mitigate risks. One property owner avoided a $2,000 repair bill when their guest’s rental car was damaged, thanks to their card’s collision coverage. Another traveler received reimbursement for a stolen laptop during their stay at a beach resort.

To maximize these benefits, always verify the fine print of your credit card policy. Look for clauses related to travel, property, and vehicle coverage. By combining credit card insurance with a standalone policy, you can ensure comprehensive protection for your property and guests.

How to Avoid Insurance Scams and Hidden Fees in Playa del Carmen

Navigating the insurance landscape in a bustling tourist destination requires vigilance to avoid scams and hidden fees. While securing coverage is essential, it’s equally important to ensure transparency and fairness in your policy. We’re here to guide you through the process of identifying red flags and asking the right questions to protect your investment.

Recognizing Red Flags

Scammers often target busy locations like airport rental hubs, where travelers are in a hurry and may overlook details. One common tactic is exaggerating fees or offering unclear policy terms. For example, some providers may charge extra for basic coverage or hide fees in the fine print.

Another red flag is pressure to sign quickly without reviewing the policy. Legitimate providers will give you time to read and understand the terms. Always make sure to verify the company’s credentials and check online reviews for any complaints.

Here are some indicators of potential scams:

- Unusually low prices that seem too good to be true.

- Lack of transparency about coverage details.

- Requests for payment through untraceable methods like wire transfers.

Key Questions to Ask Providers

Asking the right questions is the best way to ensure you’re getting a fair deal. Start by clarifying all fees, including administrative charges or additional coverage costs. For example, ask if there are any hidden fees for processing claims or extending the policy.

It’s also important to understand the scope of coverage. Does the policy include theft, vandalism, or natural disasters? If you’re using a credit card for payment, check if it offers any supplementary insurance benefits.

Here’s a checklist of questions to ask:

- What is included in the base price, and what are the additional fees?

- Are there any exclusions or limitations in the policy?

- How are claims processed, and what documentation is required?

For more insights on securing the best deals, explore our guide on financing options, which includes tips on navigating the local market.

Documentation and Claims Process Explained

Understanding the documentation and claims process is essential for protecting your property and ensuring smooth transactions. Proper records and clear communication can save you time and stress when unexpected events occur. We’re here to guide you through organizing your documents and filing claims efficiently.

Keeping Records Organized

Thorough documentation is the foundation of a seamless claims process. Start by creating a system to store all relevant records, such as receipts, photos, and signed agreements. This ensures you have everything you need when filing a claim.

Here’s a step-by-step guide to organizing your records:

- Label and categorize: Use folders or digital tools to separate documents by type, such as property damage or liability claims.

- Take photos: Capture clear images of your property and any incidents to support your claims.

- Save receipts: Keep all receipts for repairs, replacements, or related expenses.

By staying organized, you can quickly access the necessary information when needed. This saves time and ensures a smoother claims process.

Filing a Claim Successfully

Filing a claim can seem daunting, but with the right approach, it’s straightforward. Start by reviewing your policy to understand the coverage and requirements. Then, gather all supporting documents, such as photos, receipts, and incident reports.

Follow these steps to file a claim:

- Contact your provider: Notify them as soon as possible to initiate the process.

- Submit documentation: Provide all required records, including photos and receipts.

- Follow up: Stay in touch with your provider to track the progress of your claim.

Time is critical when filing a claim. Most providers have specific deadlines, so act promptly to avoid delays. Clear communication with your provider and any involved drivers ensures a smooth resolution.

By following these guidelines, you can handle the documentation and claims process with confidence. Proper preparation and organization protect your property and ensure peace of mind.

Real-World Experiences: Insights from Vacation Rental Owners

Hearing real stories from property owners can provide invaluable insights into the importance of proper coverage. We’ve gathered firsthand accounts to show how the right policies have made a difference in challenging situations. These experiences not only build trust but also offer actionable advice for safeguarding your investment.

One owner shared how their travel plans were saved when a guest accidentally damaged their property. Thanks to comprehensive coverage, the repairs were fully paid for, and the owner avoided a significant financial setback. This highlights the importance of having a policy that protects against unexpected incidents.

Another story involves a guest who rented a vehicle and caused damage to the driveway. The owner’s liability coverage stepped in, covering the repair costs and legal fees. This example shows how proactive planning can turn potential disasters into manageable situations.

Here are some tips based on these experiences:

- Always verify your policy details to ensure it covers guest-related incidents.

- Consider additional protections like theft or vandalism coverage for extra security.

- Communicate clearly with guests about safety measures to reduce risks.

“Having the right insurance gave me peace of mind during a stressful situation. It’s a must for any property owner.”

Lessons learned from these stories emphasize the value of proactive planning. By understanding potential risks and choosing the right coverage, you can protect your property and ensure a positive experience for your guests. Let these real-world examples guide you in making informed decisions for your vacation property.

Ensuring Compliance with Cancellation and Renewal Policies

Understanding the fine print of cancellation and renewal policies is essential for managing your property effectively. These terms can significantly impact your financial planning and guest satisfaction. We’re here to guide you through the process, ensuring you’re well-prepared for any scenario.

Why Cancellation Terms Matter

Reading and understanding cancellation policies in rental agreements is crucial. These terms outline the conditions under which a guest can cancel their stay and the associated fees. For example, some policies may charge a flat fee, while others deduct a percentage of the total cost.

Clear communication with guests about these terms prevents misunderstandings. It also ensures you’re protected from last-minute cancellations that could leave your property vacant. Always verify the details with trusted platforms like Discover Cars to ensure transparency.

Navigating the Renewal Process

The renewal process is equally important. It ensures your property remains protected without gaps in coverage. Renewals often trigger policy updates or additional fees, so it’s essential to review the terms carefully.

For instance, if you’re managing a property near a popular cenote, your policy may need adjustments to account for increased guest traffic. Staying proactive helps you avoid unexpected costs and ensures continuous protection.

Cost Comparisons: Cancellation vs. Renewal

Understanding the cost differences between early cancellation and renewal is key to making informed decisions. Here’s a quick comparison:

| Scenario | Average Cost (USD) |

|---|---|

| Early Cancellation | $50-$100 |

| Policy Renewal | $200-$300 |

As shown, renewing your policy is often more cost-effective than dealing with cancellations. It also provides peace of mind, knowing your property is fully protected.

Staying Updated with Policy Changes

Local regulations and market trends can impact your coverage requirements. Regularly reviewing your policy ensures you’re compliant and adequately protected. For example, changes in tourist activity near a cenote may necessitate adjustments to your liability coverage.

Trusted platforms like Discover Cars offer resources to help you stay informed. Additionally, exploring best resort deals can provide insights into industry trends and guest expectations.

By understanding cancellation and renewal policies, you can manage your property with confidence. Proactive planning and clear communication ensure a seamless experience for both you and your guests.

Planning Ahead: Booking and Insurance Tips for Peak Seasons

Planning ahead for peak travel seasons ensures a stress-free experience for both property owners and guests. During busy periods, the demand for accommodations and services skyrockets, making it essential to secure the right coverage early. Let’s explore how you can prepare effectively and avoid common pitfalls.

One of the first steps is to understand the increased importance of insurance during high-traffic months. With more guests and higher activity, the risk of accidents or damages rises significantly. Ensuring your policy includes personal liability coverage protects you from potential claims, giving you peace of mind.

Booking in advance is another key strategy. Last-minute arrangements often come with higher costs and limited options. By securing your insurance plan early, you can avoid price hikes and ensure comprehensive protection. Platforms like Discover Cars offer convenient options for pre-booking, making the process seamless.

Additional charges, such as tope fees, can also impact your budget during peak seasons. These fees are often applied to cover administrative costs or extra services. Understanding these charges upfront helps you plan your finances better and avoid unexpected expenses.

Consider bundling your insurance with a tour package for added convenience. Many providers offer combined plans that include both travel and property coverage. This not only simplifies the process but also ensures you’re fully protected throughout your stay.

Here are some actionable steps to streamline your planning:

- Verify your personal liability details to ensure adequate coverage.

- Schedule policy renewals well in advance to avoid gaps in protection.

- Review additional fees like tope to understand their impact on your budget.

- Explore bundled options for insurance and tour packages to save time and money.

“Proactive planning is the key to a worry-free peak season. By securing the right coverage early, you can focus on enjoying your property and welcoming guests.”

By following these tips, you can navigate the challenges of peak travel seasons with confidence. Proper preparation not only protects your investment but also enhances the experience for your guests, ensuring a memorable stay for everyone involved.

Conclusion

Securing the right protection for your property ensures peace of mind and smooth operations. Throughout this guide, we’ve highlighted the importance of comprehensive coverage to safeguard your investment. Trusted services like Discover Cars can simplify the process, offering secure policies tailored to your needs.

We encourage you to review your current policies and consider necessary upgrades. Sharing your experiences or asking questions can also provide clarity and help others make informed decisions. By implementing these strategies, you can enjoy peace of mind and speed through processes confidently.

Let’s take the next step together. Protect your property, enhance your guests’ experience, and make every moment worry-free. Start today and see the difference the right coverage can make!