We’re excited to share our expertise with you as you consider purchasing property in Mexico, in Cancun or Playa del Carmen! As foreign buyers, it’s key to know Mexico’s real estate laws and the buying process. Property prices in Mexico are much lower than in the U.S. and Europe, making it a great value for foreign buyers. We’ll walk you through the process, making sure you understand the laws and what you need to buy in Mexico.

Our goal is to give you the knowledge you need to make a smart choice when buying property in Cancun or Playa del Carmen. With our expert team, you can easily navigate the complex process of buying property in Mexico. We’re here to help you understand the laws and ensure a smooth transaction for foreign buyers.

Key Takeaways

- Understanding Mexico real estate laws is key for foreign buyers.

- Property prices in Mexico are lower than in the U.S. and Europe, making it a better value for foreign buyers.

- Foreign buyers must set up a bank trust or create a Mexican corporation to buy property near coastlines and borders.

- Doing thorough research is important to avoid scams and ensure a smooth transaction.

- Working with a reputable notary and real estate agent is essential to navigate Mexico’s real estate laws and make a successful purchase.

Understanding the Legal Aspects of Buying in Mexico

We aim to explain the legal side of buying property in Mexico. This includes legal property investment and Mexico real estate laws. The Mexican Constitution lets foreign buyers own property, but there are rules to follow.

Foreign buyers often use the Fideicomiso trust system. It’s great for properties in restricted zones like coastlines and borders. We’ll help you understand this system and support you in dealing with Mexican real estate laws.

Important things to know about legal property investment in Mexico include:

* Foreigners can own homes in Mexico without being legal residents.

* They can buy properties outright in most areas, except for some zones.

* The Mexican Constitution limits foreign ownership in certain places, but a fideicomiso can help.

The Mexican Constitution and Foreign Ownership

The Mexican Constitution lets foreigners own property, but with some limits. We’ll cover these rules and how they impact Mexico real estate laws.

Fideicomiso Trust System Explained

The Fideicomiso trust system is a common choice for foreign buyers. It lets them hold property in a trust. We’ll explain how it works and its benefits for legal property investment in Mexico.

Rights and Restrictions for Foreign Buyers

Foreign buyers have specific rights and limits when owning property in Mexico. We’ll outline these, making sure you understand Mexico real estate laws and legal property investment well.

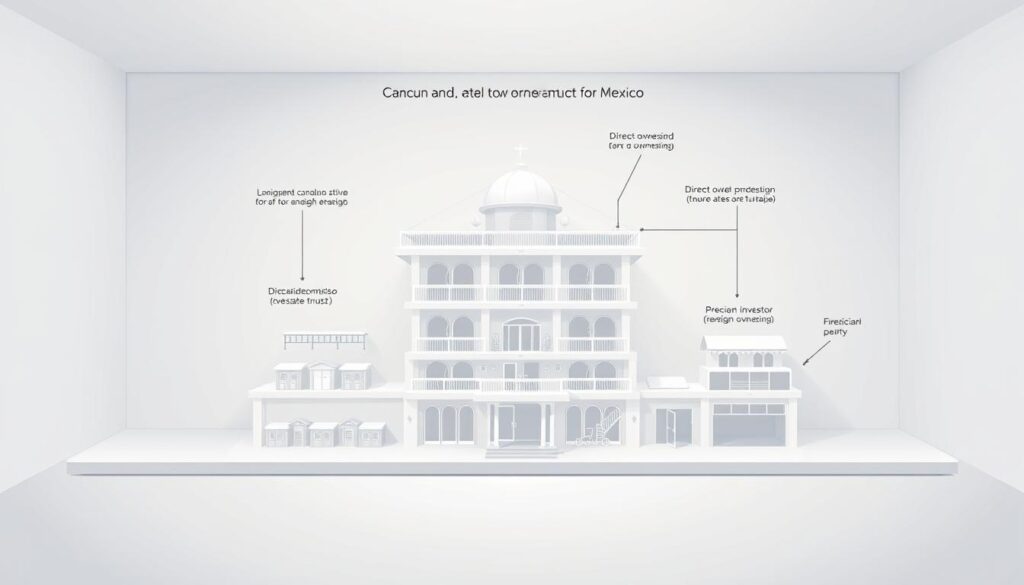

Property Ownership Structures in Cancun and Playa del Carmen

Understanding Mexico’s real estate laws can be tricky, even for foreign buyers. We’ll help you through the process. It’s important to know about the different ways to own property in Cancun and Playa del Carmen. These include condos, houses, and land, each with its own rules and needs.

Foreign buyers must follow certain rules when owning property in Mexico. For example, the fideicomiso trust system lets foreigners own property in certain areas. This includes places within 50 kilometers of the coast. It’s a safe way for foreign buyers to own property and protect their rights.

When buying property in Cancun or Playa del Carmen, consider these points:

- Acquisition tax, which is usually 2% of the property’s price

- Notary fees, which can be 1-2% of the property’s price

- Trust fees for a fideicomiso, which cost between $500 to $1,000 a year

Knowing these details and the different ways to own property helps foreign buyers make smart choices. We aim to give you the knowledge and support you need. This way, you can have a smooth and secure transaction.

| Property Type | Description | Requirements |

|---|---|---|

| Condos | Shared ownership of a building, with individual units | Must comply with Mexico real estate laws and regulations |

| Houses | Single-family homes, often located in residential areas | May require a fideicomiso trust for foreign buyers |

| Land | Raw land, often used for development or investment purposes | Must be purchased through a Mexican corporation or fideicomiso trust |

Due Diligence and Documentation Requirements

When we talk about legal property investment in Mexico, knowing about due diligence is key. For foreign buyers, this can be a bit tricky. We’re here to help you understand it better. Before you make an offer, doing due diligence is important to strengthen your position.

One important step is the title search. It can show if there are any hidden liens or easements that could affect your legal property investment. Sadly, up to 80% of buyers skip this step, which can lead to big problems. As foreign buyers, it’s important to work with a trusted notary. They can make sure all documents are correct and the property is free from surprises.

For more details on real estate laws in Playa del Carmen, check out this resource. It gives a full breakdown of the process. By knowing about due diligence and documents, you can make a smart legal property investment in Mexico. And enjoy all the good things that come with it.

Financial and Tax Implications for Foreign Buyers

Understanding Mexico’s real estate laws is key for foreign buyers. They must know about taxes and fees when buying property. Acquisition tax can be 2% to 4% of the sale price, depending on where you buy.

Also, foreign buyers face a capital gains tax of 35% on profit or 25% of the selling price. Predial tax rates are 0.1% to 0.5% of the property’s value, with discounts for early payment. Knowing these taxes helps make a smart legal property investment choice.

Here are some key points to consider:

- Withholding income tax rate from leasing real estate through a Mexican Trust is 25% of the gross income.

- A 16% Value Added Tax rate may apply to transactions involving leasing real estate in Mexico.

- U.S. residents are subject to progressive tax rates up to 37% on income derived from a Mexican Trust.

By grasping the financial and tax aspects of buying in Mexico, foreign buyers can successfully invest. We aim to give you the knowledge to make a well-informed decision. This ensures you follow all regulations.

| Tax Type | Rate |

|---|---|

| Acquisition Tax | 2-4% of sale price |

| Capital Gains Tax | 35% of profit or 25% of gross selling price |

| Predial Tax | 0.1-0.5% of assessed value |

Conclusion: Making an Informed Property Investment Decision

Buying property in Mexico, like in Cancun or Playa del Carmen, is complex. Foreign buyers must grasp the Mexican Constitution and legal property investment choices. They also need to do thorough research to make a successful buy.

With the help of local experts, you can face these challenges head-on. They can help you make the most of owning a home in this beautiful area. You’ll learn how to handle everything from title searches to notary duties, keeping your investment safe.

To make a smart choice, stay informed and ask the right questions. Surround yourself with advisors you trust. With their help and your hard work, you can make your dream of a Mexican paradise come true.