We’re excited to share our expertise on the economic factors that influence long-term rental properties in Playa del Carmen! We’ll explore how tourism, foreign investment, and local economic growth shape the real estate market. We’ll use data from trusted sources to give you insights into the market’s current state and future growth.

Playa del Carmen’s real estate market thrives on tourism, foreign investment, and local economic growth. The current exchange rate makes it cheaper for U.S. dollar holders to invest in Mexican real estate. This can lead to higher savings. Rental yields in tourist areas like Playa del Carmen can exceed 10%.

It’s important to understand these economic factors for smart decisions, whether you’re investing or owning a home. We’ll dive into how these factors affect the market. This will give you the knowledge you need to navigate Playa del Carmen’s long-term rental property scene.

Key Takeaways

- The current exchange rate offers a favorable investment opportunity for U.S. dollar holders in Mexican real estate.

- High rental yields in Playa del Carmen make it an attractive location for investors.

- Tourism and foreign investment drive the local economy and impact rental property values.

- Understanding economic factors is essential for making informed investment decisions.

- Playa del Carmen’s real estate market is influenced by a combination of local and global economic factors.

- Rental demand is increasing due to expanding expat communities and the remote work trend.

Current State of Playa del Carmen’s Real Estate Market

We’re excited to share our insights on Playa del Carmen’s real estate market. The market has seen a lot of growth, with property values and rental demand going up. This growth is making the Playa del Carmen market very strong, with a big demand for long-term rentals.

Real estate prices in Playa del Carmen have jumped over 50% in a few years. They’re now stabilizing at a higher level. This increase is because of the area’s popularity with tourists and expats. They love the beautiful beaches and lively culture here. So, there’s a lot of demand for long-term rentals.

Market Growth Trends

Some key trends in the Playa del Carmen market include:

- Beachfront property demand is expected to rise by 10% annually, outpacing supply by 2025.

- The number of eco-friendly residential developments is anticipated to grow by 50% by 2027.

- Property prices per square meter increased from $2,471 to $3,830 from 2015 to 2024.

Rental Demand Statistics

The rental market in Playa del Carmen is looking good, with an average rental yield of 8.5%. This makes it a great choice for investors. With over 15 million visitors each year, the demand for rentals is high. This supports the growth of the Playa del Carmen market.

Economic Factors Affecting Playa del Carmen Rentals

We’re looking at what affects Playa del Carmen rentals. Sources say tourism, foreign investment, and local growth are big players. Over 10 years, Playa del Carmen has grown from a small fishing village to a bustling city.

Tourism brings in millions of visitors each year. This demand boosts property value appreciation. Properties near attractions or beaches see bigger price hikes.

- Short-term rentals in Playa del Carmen are in high demand, pushing up prices.

- Beachfront properties are more expensive than inland ones because of their unique appeal.

- New infrastructure like highways and public transport is also raising property values.

Understanding tourism, foreign investment, and local growth is key. It helps us make smart choices when investing in Playa del Carmen rentals.

The economic factors in Playa del Carmen rentals are complex. By diving into these, we can better understand the market. This knowledge helps us make informed investment decisions in this lively city.

| Location | Average Daily Rate (ADR) | Median Occupancy Rate |

|---|---|---|

| Playa del Carmen | $150 | 65% |

| Tulum | $250 | 67% |

| Cancun | $200 | 70% |

Tourism Impact on Rental Property Values

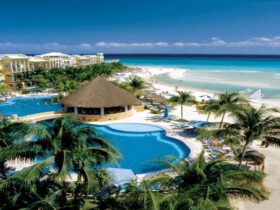

Tourism greatly affects the rental property market in Playa del Carmen. The area’s beautiful beaches, lively nightlife, and cultural heritage draw millions of visitors. This boosts the demand for rental properties, leading to higher rental property values during peak seasons.

The effects of tourism on rental property values are complex. It increases demand for short-term rentals, which can be more profitable than long-term leases. At the same time, it raises occupancy rates, which can also increase property values. Key factors influencing rental property values in Playa del Carmen include:

- Seasonal shifts in tourist demand

- Digital nomad influence

- Hotel vs. rental property competition

The average rental price for a one-bedroom apartment in the city center is about $800 per month. Properties near the beach or Quinta Avenida usually cost more due to higher demand. Understanding these factors is vital as we examine the link between tourism and rental property values.

Local Economic Development and Infrastructure

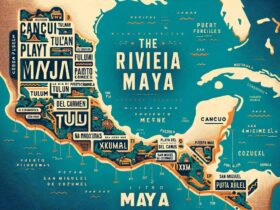

We understand how important local economic development is for Playa del Carmen’s real estate. Its spot on the Riviera Maya draws tourists and investors. The local government works hard to improve infrastructure, like roads and marketing.

Playa del Carmen’s economy is growing thanks to:

- Millions of visitors each year

- More hotels, resorts, and vacation rentals

- Easier access to places like Cancun and Tulum

Infrastructure growth is key for the town’s tourism. New roads, public transport, and amenities are being built. This investment helps Playa del Carmen stay a top tourist spot.

| Year | Property Price Increase | Tourism Growth |

|---|---|---|

| 2020-2021 | 3-5% | 10% |

| 2022-2023 | 10-12% | 15% |

Looking ahead, local economic development and infrastructure are key for Playa del Carmen’s real estate. Knowing these factors helps investors and homeowners make smart choices.

International Investment Influences

We see how international investment shapes Playa del Carmen’s real estate. Trends show foreign direct investment is key. Home prices have jumped 17.1% in Quintana Roo and 16.8% in Playa del Carmen, drawing in investors.

The area’s beauty, culture, and economic growth attract investors. We must look at the good and bad sides of international investment. This includes how currency exchange and cross-border deals affect the market.

Foreign Direct Investment Trends

- Increased demand for long-term rental properties

- Growing interest in luxury residential areas, such as Playacar

- Expansion of commercial real estate, including retail spaces and mixed-use developments

Looking ahead, we must be aware of the risks and challenges. By understanding these, we can make smart choices. This way, we can take advantage of international investment and foreign direct investment.

Risk Assessment and Market Challenges

Investing in Playa del Carmen’s real estate market has its risks and challenges. We look at economic changes, new rules, and how full the market is. The Mexican economy is slowly getting better after tough years due to COVID-19, which affects real estate.

We also check how the US dollar affects prices. The dollar’s strength can change how much real estate costs in Mexico. Plus, we look at the rules, like new laws on vacation rentals. These rules are strict and require following local laws for places like Airbnb.

Some big challenges we’ve found include:

- Economic changes like price swings and the dollar’s effect

- New rules on vacation rentals and the need to follow local laws

- How full the market is, which can affect demand and returns

Knowing these risks and challenges helps us make smart investment choices in Playa del Carmen. For more details on the local market and to find great options, check out Playa del Carmen resorts and learn more about the area.

Future Growth Projections

We are excited to share our future growth projections for Playa del Carmen’s real estate market. The market is expected to grow, thanks to new developments and investments. The future growth will be driven by more demand for vacation rentals and investment properties.

Our projections show that property prices in Playa del Carmen will rise. We expect a 3% to 7% increase by 2025. This growth will come from new infrastructure, more tourism, and a demand for alternative accommodations. Neighborhoods like Playacar, Centro, and Coco Beach are expected to see the biggest price hikes.

Here are some key statistics that support our future growth projections:

- Estimated property price increase in Playa del Carmen in 2025: 3% to 7%

- Typical annual appreciation rate for real estate in growing markets like Playa del Carmen: 3% to 7%

- Estimated price of a 2-bedroom condo near the beach in 2025: $257,500 to $267,500

We believe Playa del Carmen’s real estate market has a bright future. It offers many opportunities for growth and investment. Whether you’re an experienced investor or new to the market, we invite you to explore the possibilities here.

Conclusion: Making Informed Investment Decisions in Playa del Carmen

The real estate market in Playa del Carmen is full of informed investment decisions. It’s a great place for those looking to make money. With its lively tourism and growing economy, Playa del Carmen is a top choice for investors and homebuyers.

Knowing the local economy, tourism, and market trends is key. This knowledge helps investors make smart choices. Whether you want rental properties, vacation homes, or commercial real estate, there are many good options here.

This article has given you valuable insights into the Playa del Carmen real estate scene. It helps you understand the market and make smart decisions. With the right strategy, investing here can be very rewarding.